No one likes to hear the words “it’s going to cost more than you expected.” But sadly, it’s starting to become the norm. Over the last few years, we’ve seen that car repair prices are climbing. Parts, as well as labour costs, supplier lead times, and even the basics like oil and brake fluid, have all crept up.

And when customers can’t cover the cost up front, it puts pressure on the whole process. Delayed approvals, abandoned jobs, and awkward conversations aren’t going to help your garage get the work out the door. But there are simple ways to make things easier, not just for your customers, but for your workshop and your bottom line.

Why Car Repairs Are Costing More

It’s not your imagination; things really are more expensive. There are a few reasons for that.

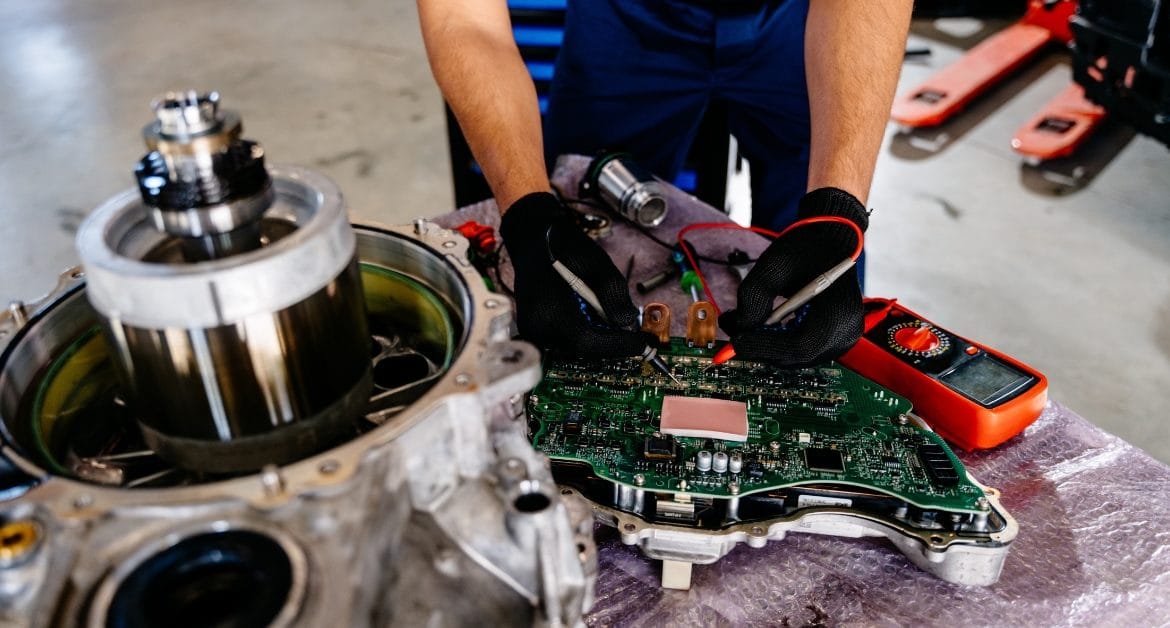

For starters, modern vehicles are more complex. That means you’ll be dealing with more diagnostics and more specialist parts, so you’re probably spending more time under the bonnet. At the same time, inflation has driven up costs across the board, from components to consumables.

Add in labour shortages, longer wait times for parts, and squeezed supplier margins, and it’s hardly a surprise that costs are going up. Unfortunately, it’s not likely that this is a temporary blip. Vehicles are going to continue to get more technical, and manufacturers will keep tightening specs. We can, therefore, expect higher prices for car repairs to stick around.

Crunching the numbers.

According to the Office for National Statistics, the maintenance of motor vehicles cost index rose by 6.8% in 2024. For context, general inflation was roughly half that, standing at 3.5% in April this year. Pothole-related repairs alone now cost UK drivers about £144 on average each year, and garages reported average labour-rate increases of 2.5% in 2024.

There’s a Knock-On Effect for Garages

Many customers either don’t or can’t budget for unexpected car repair costs. And when the cost jumps from a couple of hundred quid to over a grand, it’s understandable for people to get cold feet. That’s when they choose to put things off. They ask to think about it and say they’ll call back later. How many times does that end with no reply, no booking, no revenue? That wasted time ends up costing you.

Helping Customers Say Yes Sooner

The easier it is for someone to say yes, the faster the work gets done.

That’s why more garages are looking at ways to make car bills that little bit more manageable, especially when budgets are tight. One way to do that is by offering flexible ways to pay. Giving customers the option to spread the cost over a few months with a buy now, pay later package can be a massive helping hand. If someone can get the work done now without having to fork out for a huge bill, they’re much more likely to agree to the work there and then. That means faster approval and faster turnaround, too.

Do Rising Car Repair Costs Create an Opportunity?

Strangely, the answer could be yes. If you can find a way to make life easier for your customers, they’ll remember it. And in a market where trust is everything, that gives you the edge over competitors who are still expecting full payment up front.

Adding a buy now, pay later option is a powerful way of tapping into a business growth opportunity. More completed jobs, fewer abandoned quotes, better customer loyalty. It helps you turn a one-off visit into a long-term relationship.

And from a practical point of view, offering a flexible payment option shows you actually understand the reality most people are living in. Cost-of-living pressures are a real hurdle. Being the garage that gets the struggle? That could make a big difference.

Keeping the Workshop Flowing

Let’s face it, time is money. The longer a job sits waiting for customer approval, the more it clogs up your schedule. Offering a simple way to spread the cost keeps jobs moving. You’re not waiting for a payday or chasing phone calls. You’re just getting the work done.

And because these kinds of payment options are handled externally, there’s no risk you’re taking on. You aren’t acting as the lender, but you are making it easier for your customers, both new and old, to afford the repairs they need. It’s a win-win for everyone involved.

Want to Help Your Customers with Increasing Car Repair Costs?

At Payment Assist, we help garages offer a smarter way to manage rising car repair costs. Our simple, interest-free buy now, pay later service means your customers can spread the cost with no hassle and no hidden fees.

We take care of the process, from approval to payment, so you can focus on the job at hand. There isn’t any risk, and there’s no upfront cost to your business. You just get a better way to get more work signed off, faster.

Sign up with Payment Assist today, or get in touch with us with any questions about how we can help you support your customers and grow your business.

FAQs

Can offering finance delay the car repair process?

Not if the approval is instant. With the right system in place, offering finance can actually speed things up by removing decision friction.

Is buy now, pay later a good fit for smaller car repair jobs?

It can be, especially if customers are juggling multiple costs. Even spreading a £250 job can make it easier for someone to commit.

How does offering payment options affect customer loyalty?

Customers who feel supported during stressful times are more likely to return, leave good reviews, and recommend your workshop to others.

Do customers need good credit to buy now, pay later?

At Payment Assist, we only check that the card has adequate funds to pay the initial deposit, and make sure the address registered to the Debit card matches. We very rarely carry out full credit checks.